City paycheck calculator

What PaycheckCity Does What You Do. Cities and counties do not impose this tax but some do affecting approximately 10.

Paycheck Calculator Take Home Pay Calculator

Cost Of Living Index Current Cost Of Living Index.

. This is state-by state compliant for those states that allow the aggregate method or percent method of bonus calculations. The MoneyGeek calculator allows you to run cost of living comparisons of expenses in nearly 500 US. Cost Of Living Index By Country.

Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. Calculating your Alabama state income tax is similar to the steps we listed on our Federal paycheck calculator. Calculate your Florida net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Florida paycheck calculator.

Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents. Residents and anyone who works in either city must pay this tax. Iron Countys average effective property tax rate is 057 which ranks right in the middle of Utahs 29 counties.

You should consider other deductions from your paycheck such as Social Security tax Medicare tax state tax local tax insurance. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Tax year Filing status Adjusted gross.

Flexible hourly monthly or annual pay rates bonus or other earning items. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

How You Can Affect Your Utah Paycheck. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. To build it MoneyGeek combined data from the Council for Community and Economic Researchs Cost of Living Index employment data from the US.

Work out your adjusted gross income. The PaycheckCity salary calculator will do the calculating for you. This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Because there is only one. Switch to Massachusetts salary calculator. Other paycheck deductions are not taken into account.

Figure out your filing status. 42196 16200-Price per Square Feet to Buy Apartment Outside of Centre. What does eSmart Paychecks FREE Payroll Calculator do.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax. This number is the gross pay per pay period. The county contains about 30 tax districts but much of the county is unincorporated.

Sales taxes are another important source of revenue for state and local governments in. Computes federal and state tax withholding for paychecks. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Switch to Iowa hourly calculator. Switch to Florida hourly calculator. You rest assured knowing that all tax calculations are accurate and up to date.

Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. PaycheckCity calculates all taxes including federal state and local tax for each employee.

Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken out. Switch to North Carolina hourly calculator. Exempt means the employee does not receive overtime pay.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Subtract any deductions and payroll taxes from the gross pay to get net pay. In addition to the state tax St.

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. Switch to Illinois salary calculator. Switch to Connecticut hourly calculator.

It can also be used to help fill steps 3 and 4 of a W-4 form. Bureau of Labor Statistics and demographic data from the US. San Francisco Income Tax Information.

They are the only cities in Missouri that collect their own income taxes. The largest city in Iron County is Cedar City. Dont want to calculate this by hand.

Then enter the employees gross salary amount. Price per Square Feet to Buy Apartment in City Centre. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Federal income taxes are also withheld from each of your paychecks. Calculate your Connecticut net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Connecticut paycheck calculator. It covers mortgage rates and other important information for moving to the city.

Louis and Kansas City both collect their own earning taxes of 1. Cost of Living Calculator. How Your New Jersey Paycheck Works.

Cost of Living Estimator.

Tax Calculator For Paycheck Store 52 Off Www Wtashows Com

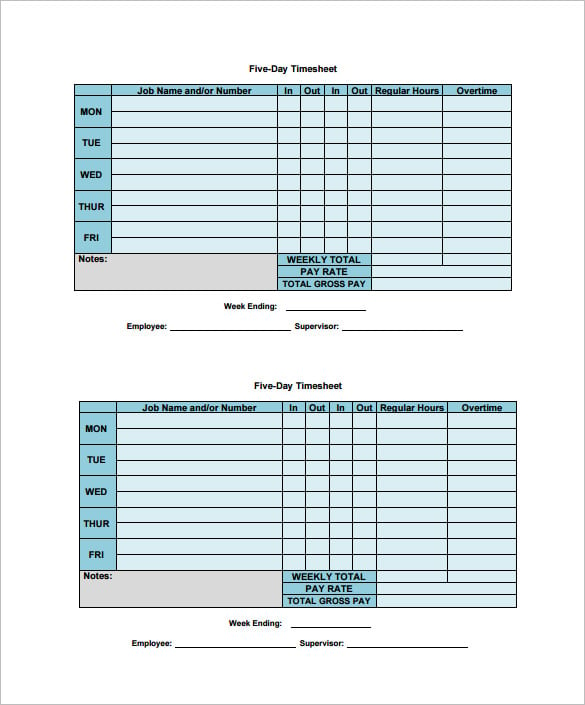

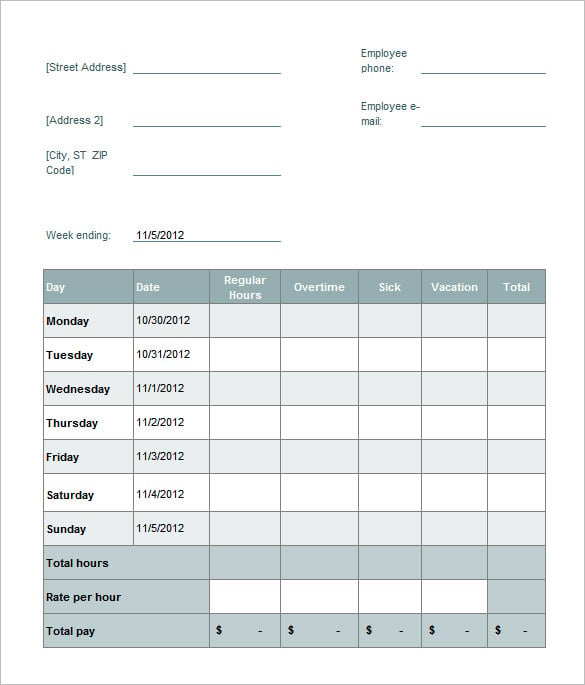

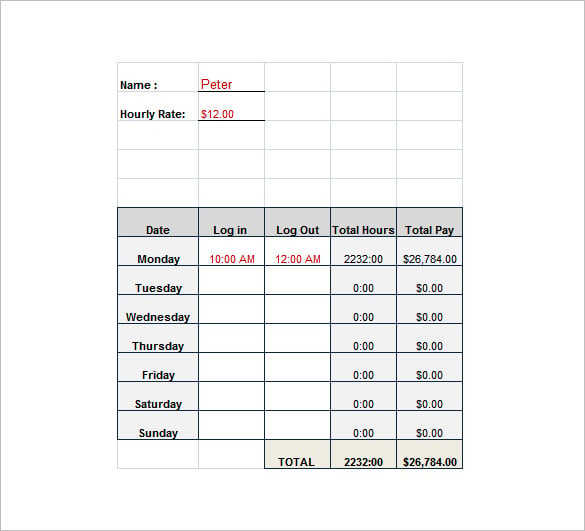

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Calculator Take Home Pay Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Equivalent Salary Calculator By City Neil Kakkar

Free Paycheck Calculator Hourly Salary Usa Dremployee

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Calculator Us Apps On Google Play

Hourly Paycheck Calculator Cheap Sale 50 Off Www Wtashows Com

Hourly Paycheck Calculator Hot Sale 51 Off Www Wtashows Com

1wxmydejhzto9m

Payroll Online Deductions Calculator Outlet 50 Off Www Wtashows Com

Take Home Salary Calculator Store 50 Off Www Wtashows Com